Place of Establishment V/s Fixed Establishment | UAE VAT laws | Learn under a minute #learninaminute - YouTube

What is better for tax purposes, to set up a subsidiary or a permanent establishment in Spain? - IR Global

EUROPEAN UNION - CJEU confirms local staff required to have a fixed establishment for VAT purposes - BDO

Fixed establishment even in the absence of own human and technical resources? | KMLZ Rechtsanwaltsgesellschaft mbH

Concept of Fixed Establishment remains a huge concern for businesses ...... an overview of recent developments - VATupdate

VAT: Cross border pro rata applies to costs incurred by fixed establishment | Meijburg & Co Tax & Legal

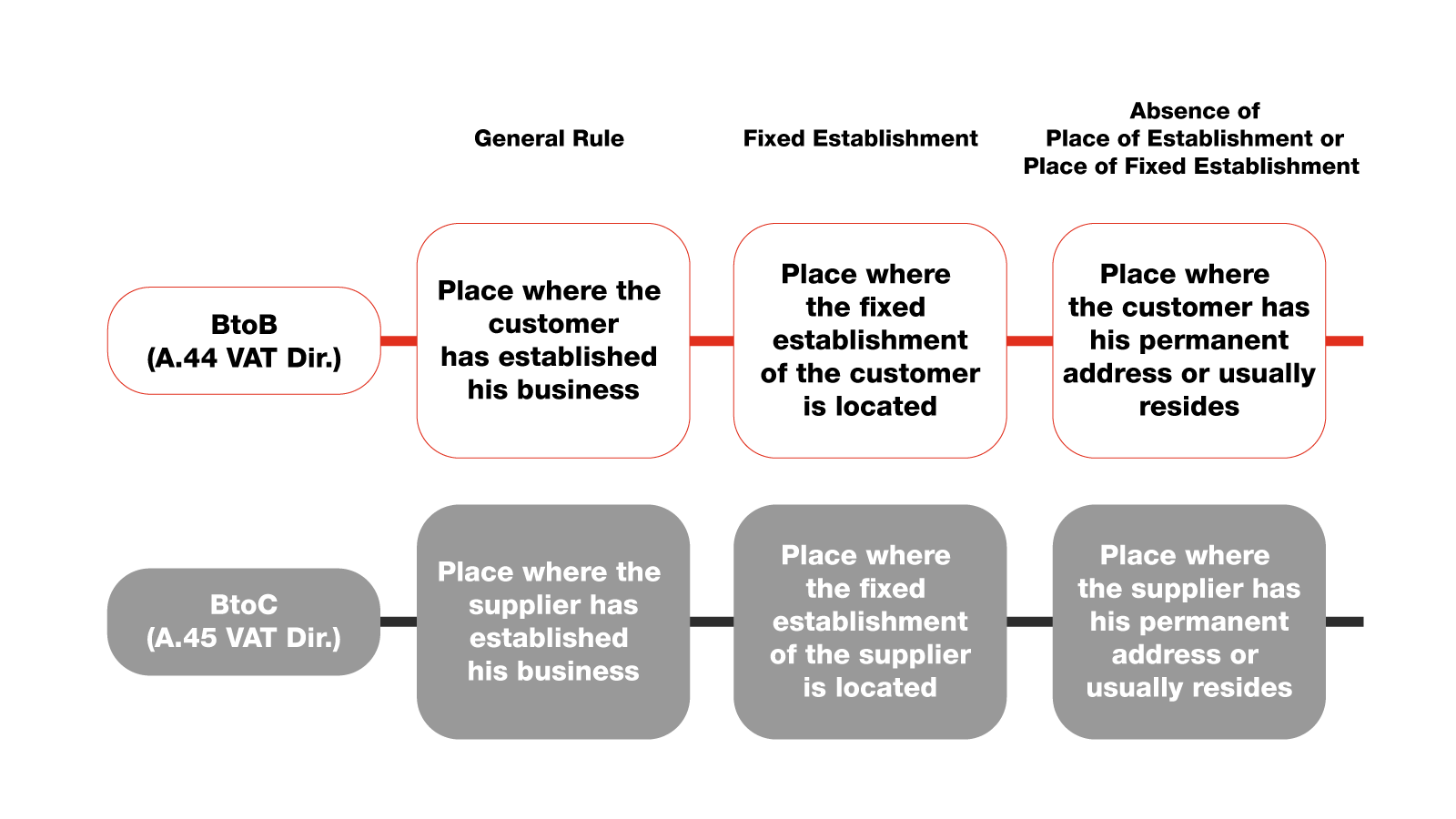

Malta Institute of Taxation - This seminar is now being held on the 27 April 2022. The VAT notions of 'establishment' and 'fixed establishment' are relevant when applying VAT in a cross-border